Monthly Archives: July 2025

AUD Rebounds, But Dovish Risks Still Dominate

Written on July 9, 2025 at 3:11 am, by pumarketings

Key Takeaways:*The RBA’s surprise decision to hold at 3.85% triggered a short-term AUD rebound, but markets remain firmly positioned for an August cut, with an 85% probability priced and terminal rates seen at 3.0%. *Trump’s 50% copper tariff targets a key Australian export, deepening AUD’s vulnerability to global trade fragmentation. External demand risks now capContinue Reading

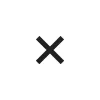

Yen Under Pressure as Policy and Trade Risks Mount

Written on July 9, 2025 at 3:09 am, by pumarketings

Key Takeaways:*With swaps now pricing just 10bps of tightening, Japan’s monetary inertia continues to weigh heavily on the yen. *Washington’s proposed 25% tariffs on Japanese goods erode the yen’s safe-haven appeal. *Despite a strong current account and cheap yen, structural drags—subdued wage growth and fragile domestic demand—undermine the JPY. Market Summary: In a televised cabinetContinue Reading

Copper Soars to Record High as Trump Proposes 50% Tariff on Imports

Written on July 9, 2025 at 3:04 am, by pumarketings

Key Takeaways:*President Trump proposed an additional 50% tariff on imported copper to boost domestic production, jolting financial markets. *The announcement sent copper prices soaring over 10% to $5.67/lb, an all-time high, as traders reacted to potential supply disruptions and increased costs. Market Summary: In a televised cabinet session yesterday, President Trump jolted markets once againContinue Reading